pa inheritance tax exemption amount

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents property in accordance with Section 3121 of the Probate Estate and Fiduciaries Code. However when the decedent held title jointly with another or others.

Naming A Trust As Beneficiary Of A Retirement Plan Retirement Planning How To Plan Estate Planning

The tax is exempt for any property owned by a spouse.

. They are required to report and pay tax on the income from PAs eight taxable classes of income that they receive during their taxable year. The PA inheritance tax rate is 12 for property passed to siblings. If the decedent dies before the tax can be paid the heirs will pay the PA inheritance.

The federal gift tax has an exemption of 15000 per recipient. 45 for any asset transfers to lineal heirs or direct descendants. Charitable Deduction For Federal Estate Tax purposes a deduction is allowed for charitable bequests.

Life insurance is exempt from PA inheritance tax and federal income tax. Effective for dates of death after July 1 2000 the Pennsylvania Inheritance Tax rate is 45 for direct descendants lineal heirs grandfather grandmother father mother children and a rate of 12 for transfers to a sibling an individual who has at least one parent in common with the decedent whether by blood or adoption. The tax rate depends on the relationship of the decedent and the beneficiaries or heirs.

What is the family exemption and how much can be claimed. The Pennsylvania inheritance tax rate is a percentage of the decedents estate. Expenses incurred in administering real property held in the decedents name alone are allowed in reasonable amounts.

Estates valued at less than 1206 million in 2022 for single individuals are exempt from an estate tax. If the gift or estate includes property the value of the property is. 15 for asset transfers to other heirs.

REV-714 -- Register of Wills Monthly Report. The tax rate is. REV-1381 -- StocksBonds Inventory.

The estate tax is a tax on an individuals right to transfer property upon your death. Real estate e tax purpo ssets of th efines me. For a person with no children the tax will be lower.

Life insurance payments on the life of the deceased are exempt from the Pennsylvania Inheritance Tax. Who pays inheritance tax in PA. There is no gift tax in Pennsylvania.

To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily or lea d principal or leased the exempt ildings not the followi ing campin s fish cat ctivities. The farmland must produce an annual gross income of at least 2000. REV-1313 -- Application for Refund of Pennsylvania InheritanceEstate Tax.

REV-720 -- Inheritance Tax General Information. The family exemption is 3500. Property that is owned jointly between two spouses is exempt from inheritance tax.

For decedents dying after Jan. Estates and trusts are taxpayers for Pennsylvania personal income tax purposes. In the event there is no spouse or child the exemption may be.

The PA inheritance tax rate is 45 for property passed to direct descendants and lineal heirs. Estates and trusts report income on the PA-41 Fiduciary Income Tax return. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

It does not matter if they pass to the estate or directly to the beneficiary. 29 1995 the family exemption is 3500. Pennsylvania also allows a family exemption deduc-tion of 3500 paid to a member of the immediate family living with the decedent at the time of death.

Pennsylvania Inheritance Tax Safe Deposit Boxes. 12 for asset transfers to siblings. The Pennsylvania estate tax is owed by out-of-state heirs for real property and tangible personal property located in the Keystone State.

The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania. REV-1197 -- Schedule AU -- Agricultural Use Exemptions. The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than 50000 not including real property like land or a home and other final expenses must go through the probate court process under Pennsylvania inheritance laws.

It is a flat rate on most assets. January 21 2013 by Law Offices of Spadea Associates LLC. The family exemption is generally payable from the probate estate and in certain instances may be paid from the decedents trust.

The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. And to find the amount due the fair market values of all the decedents assets as of death are added up. If there is no spouse or if the spouse has forfeited hisher rights then any child of the decedent who is a member of the same household as the decedent may claim the exemption.

1 Any funds after that will be taxed as they pass. The Commonwealth of Pennsylvania created the Family Exemption to help the children or surviving spouse who lived with the deceased and relied on that persons assets or income to take up to 3500 from the decedents bank account until the estate account is opened. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

Are fully deductible for Pennsylvania Inheritance Tax purposes. A total of 45000 will be charged. The exemption is 117 million for 2021 Even then youre only taxed for the portion that exceeds the exemption.

The PA inheritance tax rate is 15 for property passed to other heirs excluding charities and organizations that are exempt from PA inheritance tax Data Source.

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

How Do State Estate And Inheritance Taxes Work Tax Policy Center

What Is A Homestead Exemption And How Does It Work Lendingtree

Pin On Real Estate Information For Buyers And Sellers

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

What Are Marriage Penalties And Bonuses Tax Policy Center

Tax Planning Q A For Canadian Physicians Dr Bill

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

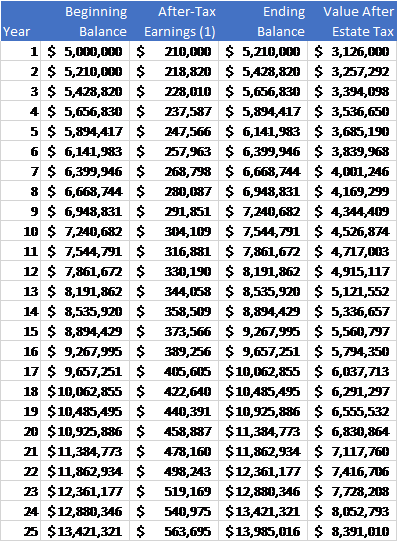

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

Named In The Will What To Know About Canadian Inheritance Tax Laws 2022 Turbotax Canada Tips

10 Ways To Be Tax Exempt Howstuffworks

Requirements For Tax Exemption Tax Exempt Organizations

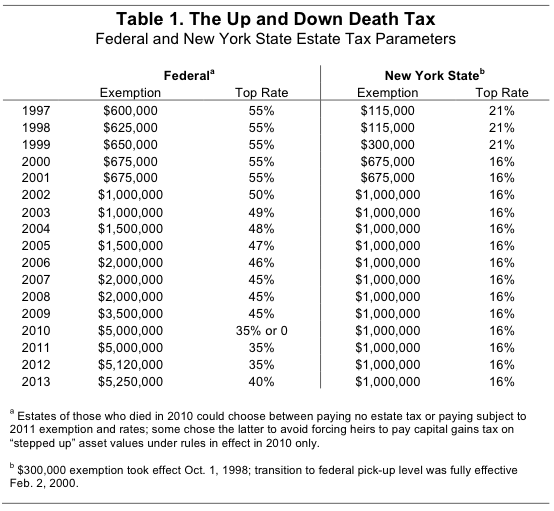

New York S Death Tax The Case For Killing It Empire Center For Public Policy

International Estate And Income Tax Planning Strategies

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Gift Tax How Much Is It And Who Pays It

New York S Death Tax The Case For Killing It Empire Center For Public Policy